Let’s discuss leases, the stuff companies rent, like office spaces or delivery vans. You’ve seen them hiding on balance sheets we see on SEC website, right? Well, buckle up because we’re diving into ASC 842, but here’s the twist: Most articles when we search on Google or Bing, sound like they’re reciting a legal thriller. Long intros, fancy words, and very less practical tips. So, grab your Favorite pen (or keyboard) because we’re decoding this puzzle. No jargon, just plain journal entries—like a recipe for financial clarity.

Assuming you’re already familiar with the difference between operating and financial leases (and if not, don’t worry, I’ll cover that separately), let’s zoom in on the practical stuff: journal entries and Excel calculations. Think of it as our backstage pass to lease accounting, no red velvet ropes, just the nitty-gritty details:

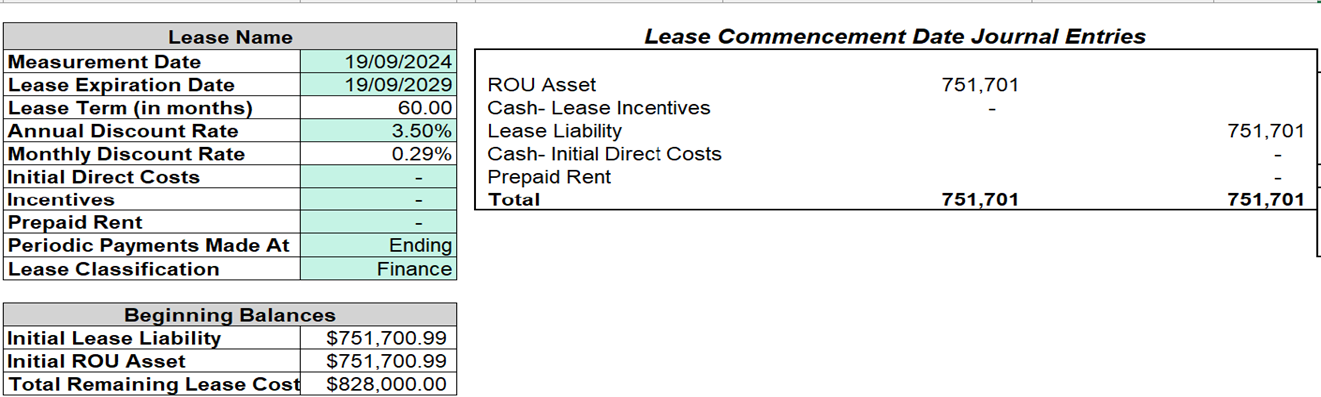

We will start with a simple yet comprehensive example:

Lease Term = 5 Years or 60 Months.

Lease Start Date= 19 September 2024.

Interest Rate= 3.498% (We took 5 Year US Bond rate using CNBC for 19 September 2024)

Following is our rent schedule

- First Year 10,000

- 2nd Year 12,000

- 3rd Year 14,000

- 4th Year 16,000

- 5th Year 17,000

In our journey through lease accounting, we’re about to tackle the nuts and bolts of measuring the value of Right-of-Use (ROU) Asset and the Lease Liability, for operating lease or a financial lease. Buckle up as we add a dash of practicality to the mix. Now, here’s the scoop, Our Excel file is doing the heavy lifting, crunching those numbers automatically. Here I want to shout-out to Occupier for creating this stunning template. I’ve tweaked it a bit and linked those journal entries directly into the Excel sheet. Why? Because finding a template that not only shows the entries but also dances with the spreadsheet was very difficult. So, my friends, I’m sharing this gem with all of you (Link will be shared at end of article). Let’s make lease accounting a tad less mysterious and a whole lot more efficient.

Initial Value of Lease Liability and ROU Asset

So, Lets start calculating the initial value of Lease Liability.

Lease liability would be the present value of all lease payments.

Also, the calculation of ROU asset would be tricky as you have to take care of Any initial Direct cost, Incentives or prepaid rent, but don’t worry, you will see Perfect calculation in the excel sheet.

ROU asset would be = Lease Liability. + Lease incentive – Direct Cost – Prepaid Rent

So, in Our Example ROU Asset = Lease Liability (as all others are Zero)

showing you the glimpse of excel sheet below:

ASC 842 1, ROU Asset and Lease Liability Initial Recognition

A friendly reminder “When it comes to lease accounting, the initial recognition for both operating and financial leases is identical. But here’s the twist, on day 2, that’s when the accounting paths diverge.”

As we successfully Record our Lease for both classifications we will move towards monthly Journal Entries, we will be discussing Entries related to both classification for ease:

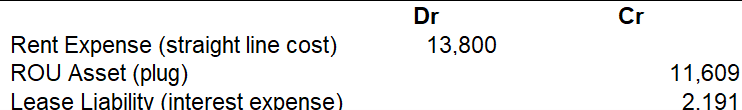

Operating Lease Monthly Journal Entry:

Rent/Lease Expense (Dr)

ROU Asset (Cr) (It will decrease value of ROU Asset)

Lease Liability (Cr) (Its basically Interest expense which is increasing the liability value)

So, in Our example above, journal entry for the First month of operating lease would appear as follows:

ASC 842 2 Operating Lease Monthly Journal Entry

Let’s explain these terms for you:

Rent/Lease Expense = (Total Remaining Lease cost + Initial ROU Asset – Initial Lease Liability)/Total Lease Months.

Where Total Remaining Lease cost would be sum of all rental payments over total lease months.

Lease Liability = Interest Expense for the respective payment

ROU Asset = Rent/Lease expense – Interest Expense

Let’s move towards the finance lease monthly Journal entry, So assume the lease is now Finance lease.

Finance Lease Monthly Journal Entry:

ROU Asset Amortization Expense (Dr)

ROU Asset Accom. Amortization (Cr)

So, in Our example above, Entry for the First month of financial lease would appear as follows:

ASC 842 Finance Lease Monthly Journal Entry

We need to define only ROU Asset Amortization expense here which would be Total of Lease Liability / Total Number of months in lease term.

A quick reminder: When it comes to finance leases, the same entry repeats throughout the lease term. So, unlike operating leases where we have monthly variations, finance lease entries keep it simple, like a well-practiced dance routine.

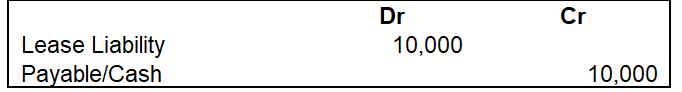

As I explained in the start of the article, We will be focusing on the practical approach, So we will be discussing the last entry of our lease Journey which is the Rent payment Entry.

Operating Lease Monthly Rent Payment Entry:

Operating Lease Monthly Rent Payment Entry:

It is very simple, For Operating Lease Actual Rent amount as per defined rate would be added in the books of account each month, So in Our example 10,000 will be added as Lease liability Reduction for first 12 months, 12,000 for second 12 months and so on. Second Impact can be a payable or a cash account based on if amount is paid or not. As we might to show unpaid lease liability in Accounts payable for correct classification.

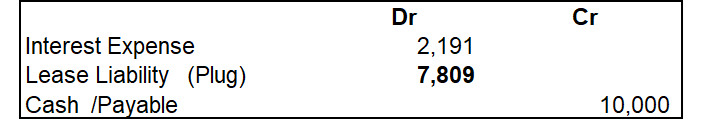

Finance Lease Monthly Rent Payment Entry:

Finance Lease Monthly Rent Payment Entry:

Now let’s assume that same lease is fiancé lease, following would be payment entry under finance lease

Here comes the tricky Journal entry for Finance lease, we can see that Cash & Payable is same however we are adding interest expense in our income statement as expense and Lease liability is simply reducing by the difference of Actual rent minus Interest expense (Plug or balancing figure).